Car Leasing in Dubai: The Hidden Charges No One Tells You About

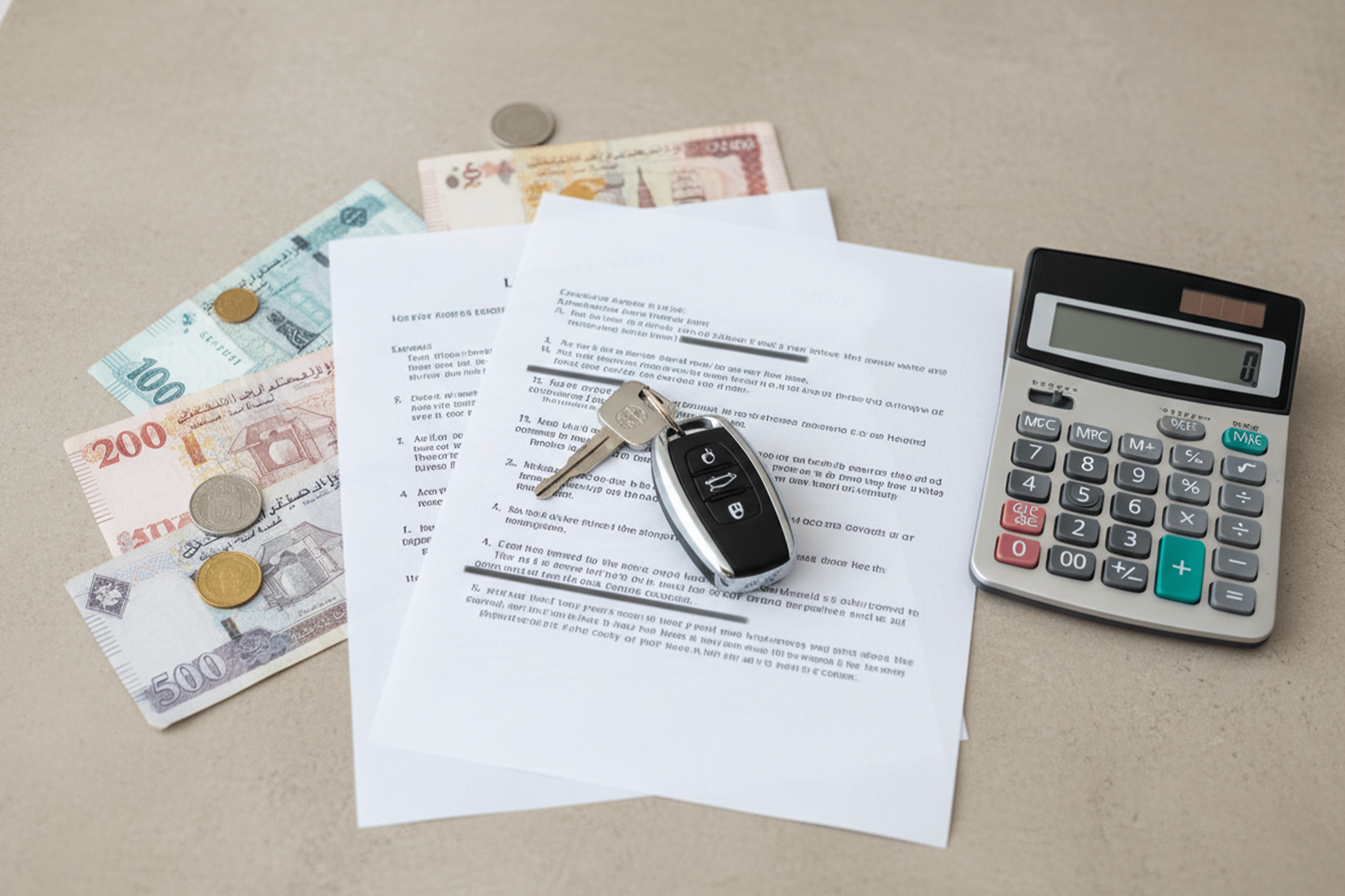

Leasing a car in Dubai sounds attractive. Be it fixed monthly payments, long-term ownership, and liberty to change models. But beneath that simplicity, there are several hidden costs that many people overlook. If you’re considering car leasing in Dubai, it’s important to know what could really drive up your bill.

What Are the Most Common Hidden Costs When Leasing a Car in Dubai?

Here are some of the key hidden charges that often surprise lessees:

| |||

| |||

| |||

| |||

| |||

| |||

| |||

|

What Happens if I Exceed the Mileage Limit on My Car Lease?

When you sign a monthly car Leasing in Dubai contract, you may agree to a maximum mileage allowance per month (or per year). If you drive more than that, your leasing company can charge you for every extra kilometre.

These over-mileage fees can add up quickly, especially if your usage is higher than what was forecasted in your lease plan.

Tip: Before signing, estimate how many kilometres you’ll likely drive in a month. If you anticipate a lot of driving, negotiate a higher mileage cap or choose a plan that offers more leeway. Otherwise, the cost of overage could easily eat into the savings of leasing.

Are There Penalties for Ending a Car Lease Early in Dubai?

Yes, terminating a lease before your agreed contract period often comes with significant costs:

A. Early Termination Fees

Many leasing companies charge a penalty for breaking the lease early. According to The National, this fee can be as high as four months’ worth of lease payments. The National

B. Depreciation and Contractual Loss

In some cases, the leasing company may factor in the car’s depreciation or the “loss” of future lease payments when calculating what you owe. According to a 2025 guide, early termination in year one could cost you 35 % of the remaining lease value, though terms vary by provider.

C. Condition Charges

When you return the vehicle early, you’ll also be subject to inspection. Any damage beyond “fair wear and tear” can lead to additional charges.

Tip: If your situation might change (job, visa, relocation), request a lease agreement that explains early termination costs in detail. Negotiate or compare different providers to find one that offers more flexible exit terms.

Why These Hidden Charges Matter for Monthly Car Leasing in Dubai

When you opt for monthly car Leasing in Dubai, the base rate might look very affordable but if you ignore hidden costs, your actual monthly outlay can be much higher. Things like Salik, over-mileage, fuel penalties, and early-exit fines may turn a “cheap” lease into an unexpectedly expensive deal.

Because of these factors, leasing companies often advertise a low “headline” monthly figure to draw you in — but they rely on overage fees, admin costs, and deposit holds to make up margin later.

How to Protect Yourself from Surprise Charges

To avoid getting blindsided by these hidden costs, follow these practical steps:

A. Get a Detailed Quote

Ask for a full breakdown of all monthly and potential add-on costs. This should include tolls, mileage allowance, fuel policy, and termination fees.

B. Inspect the Vehicle Thoroughly

When you pick up the car, walk around it, take clear photos or video, and note any existing damage. That way, when you return the car, you can avoid unfair “damage” penalties.

C. Estimate Your Driving

Know roughly how many kilometres you will drive per month/year and choose a lease plan accordingly. If you anticipate going over the limit, try to negotiate a higher mileage cap or understand the over-km rate upfront.

D. Understand the Fuel Policy

Confirm whether the lease requires the car to be returned “full-to-full” or some other policy. If it’s full-to-full, always refill before returning and keep the receipt.

E. Ask About Termination Terms

Before signing, read what the early exit cost is. Try to negotiate or compare providers that offer better flexibility or lower penalties for lease cancellation.

F. Be Clear on Fines and Admin Fees

Confirm how traffic fines (such as parking, speeding) are managed and billed. Some companies pass them on with additional admin markup.

Car leasing in Dubai can be a highly attractive option especially if you want flexibility, predictable monthly costs, and no long-term commitment. However, many people underestimate how the hidden costs can add up. For your monthly car leasing in Dubai, always look beyond the headline rate. Factor in tolls, mileage overages, fuel policy, and potential early exit fees.

By being well informed and asking the right questions, you can structure a lease that works for your budget — and avoid unpleasant surprises later. Knowledge is your best tool when directing the fine print of leasing contracts.

Why Europcar Is a Great Choice for Transparent Leasing

When it comes to car Leasing in Dubai, transparency matters. Europcar stands out because it clearly outlines its pricing, mileage limits, fuel policies, and Salik procedures upfront. There are no hidden surprises or confusing clauses. Whether you need short-term flexibility or monthly car Leasing in Dubai, Europcar keeps the process simple, predictable, and customer friendly.

Learn more about our services EUROPCARDUBAI